Tenants

Non-Insured Tenants Play Russian Roulette

Landlords know the woes of being uninsured or under insured. Properties being burnt down, or flooded often make the news. Tenants on the other hand are less informed of their liabilities and often that’s due to a “she’ll-be-right” attitude.

Landlords know the woes of being uninsured or under insured. Properties being burnt down, or flooded often make the news. Tenants on the other hand are less informed of their liabilities and often that’s due to a “she’ll-be-right” attitude.

With more people forced into renting and renting for longer – more ‘accidents’ around the home are just a reality and the liability is often left with the tenants and anyone who may have been allowed lawfully into the property at the time the incident occurred.

A recent article on stuff.co.nz identifies a couple of incidents where the tenants were found liable for property damage – not the Landlord.

Thankfully the tenant involved in one of the incidents found out their contents insurance also covered damage to the rental property – phew!

The tenant involved in the other incident was not so lucky with no insurance and liable for costs running into the tens of thousands.

So what’s the lesson to be learned by all who rent a property? Get adequate insurance to cover your personal contents and that of the property you’re renting.

Assess the affordability of the property by including the cost of insurance.

If you can afford the rent but not the insurance and you accept the property, accept you’re also playing ‘Russian Roulette’. Do you really want to risk being liable for tens or even hundreds of thousands of dollars for someone else’s property?

Who wants to risk being liable for tens or even hundreds of thousands of dollars for someone else’s property?

This blog article was written for PropertyBlogs by Mobilize Mail.

Tenants

Coworking Countdown – 4 Things to Prepare Before You Move In

The coworking scene has done anything but slowed down. Coworking spaces in Auckland alone vary between your upmarket, corporate office to the trendier, chic ones. Certainly, investing in this type of commercial real estate has never been more attractive. There is a space for everyone in this landscape and for businesses looking for new workspaces there’s not only variety available, there’s options at an affordable price.

When a business has finally found an office, in one of these buildings they have not only found a workspace, they’ve also found community as well. One coworking space – Servcorp – is a good example of the way work and networking have intersected to provide business with the chance to grow. This new way of leasing premises is highly attractive to the leasee and the property owner. Here are some tips for moving into a new coworking space, so the business can prepare to maximise their working experience.

Continue reading to learn what you can do to prepare for your move to your new coworking space to ensure the move is as seamless as possible.

Purposeful Coworking

Coworking presents professionals with the chance to use the space to just work or to build on their professional network. Before getting comfortable in your new office, sit down and take inventory of the tasks beyond work that you would like to accomplish. When writing down your goals and objectives, keep in mind the types of activities that you would like to engage in the space.

Of the many activities, formal networking events and community social events are the types you want to pay attention to if you plan to use the space to build a social network. Not that you have to be out and about every night, but scheduling time to promote your business is one way to maximise the coworking space. Ultimately, if the purpose of coworking is to build a networking platform or to grow your business, find ways to incorporate the more social aspect of the space.

Tool Of The Trade

Another thing that professionals moving into a coworking space should prepare for is knowing what amenities the space provides. Standard spaces fit out the office with exceptional IT services and office equipment, but other amenities include programs and conferences that help teach entrepreneurs how to build their businesses. Before moving into your space, consider checking out all the perks of working in your coworking space.

Moreover, make sure you know what is available for use in the office, so as to bring supplies if necessary. While staplers and other office products come standard in a conventional office, some spaces might not make this available to employees. On a larger scale, make sure there is a receptionist available, and if not, know exactly how to retrieve any messages.

Change Of Business Address

Before leaving your conventional or home office, make sure that clients and other important people know your new location and phone number. One simple way to do this is to email clients of your relocation as to avoid any mix-ups. Furthermore, make sure to forward any business mail to your new location, as to avoid missing important parcels. Finally, make sure you know the building’s office hours for scheduling appointments.

Event Calendar

Check out the coworking space’s event calendar. In addition to the numerous networking opportunities in the day, many coworking communities hold events to get the professionals to engage with each other. Make an exerted effort to attend at least a few of the events every week to raise your business’s profile. You never know what opportunity awaits when engaging people from your profession and others.

Preparing And Putting Coworking To Work

Coworking makes moving effortless simply by alleviating much of the work associated with relocating. You can, however, maximise your move by putting together an agenda of how you plan to use the work to benefit your business. Your plan will help you use your space more effectively for building a platform for business success.

Tenants

Auction Site For Renters

New Zealand will soon see the rise of a new auction site for renters. Just in on stuff.co.nz Rentberry has confirmed they will be launching here and in Australia. The online service offers renters the opportunity to bid for rental properties. Landlords set the ‘reserve’ or rent level they hope will generate lots of prospective tenants interest and then the bidding war takes off.

New Zealand will soon see the rise of a new auction site for renters. Just in on stuff.co.nz Rentberry has confirmed they will be launching here and in Australia. The online service offers renters the opportunity to bid for rental properties. Landlords set the ‘reserve’ or rent level they hope will generate lots of prospective tenants interest and then the bidding war takes off. Landlords get the final say on whom is the successful applicant and while they may review the highest bids first, they won’t be choosing the tenant just based on what they’re prepared to pay.

An Auckland property management company spokesperson said common-sense will prevail among Landlords. Securing long term tenancies with tenants that have good credit histories and references will remain the top priority. Prospective tenants information is available to the Landlord in the service so they can select the tenant without delay.

Rentberry will provide more transparency of the selection process with prospective tenants and Landlords learning what the true market value is for their property. This is a positive move for investors especially those who are new to the rental market and Landlords whom self manage their rental properties and may currently be charging more or less rent.

There has been some healthy criticism of the service even in it’s infancy. In America affordable housing advocates are angered by the service and tenant groups in Australia are wary that the service will push up prices.

Rentberry has been operating in the USA since 2016 and is currently expanding into 1000 cities there. It’s focus is on renting Apartments and this is where we see the service take off in our neck of the woods in our main centres in New Zealand.

This blog article was written for PropertyBlogs by Mobilize Mail.

Tenants

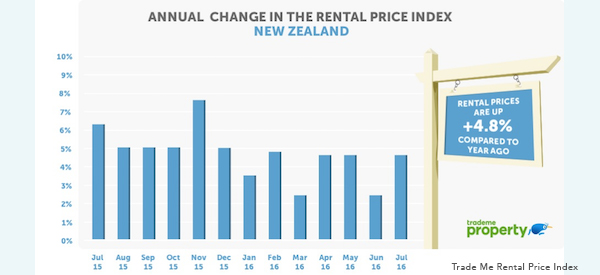

Tenants Let Off With 4.8% Increase

Weekly rents rose just 4.8 percent in the twelve months to July 2016 according to Trade Me Rent Price Index. Tenants will be relieved Landlords are being realistic and not keen on hiking rents arbitrarily. Property sales have slowed and the average asking price has dropped significantly up ten percent since July 2015.

Weekly rents rose just 4.8 percent in the twelve months to July 2016 according to Trade Me Rent Price Index. Tenants will be relieved Landlords are being realistic and not keen on hiking rents arbitrarily

Property sales have slowed and the average asking price has dropped significantly up ten percent since July 2015. Of particular interest is the slow down in property asking prices in Auckland where a typical property listed in June was just $3,750 less than the asking price in July. According to this article Investors are buying most of the houses.

In Auckland City and on the North Shore investors have purchased 50 percent of the properties on the market. A North Shore and Auckland City property management company spokesperson said investors are listing new properties with them. In Auckland City it’s mostly apartments and there’s high demand for quality living quarters downtown.

“In July 2011 New Zealand’s median weekly rent was $350 a week, that has risen by $90 a week over the past 5 years, while at the same time the increase in the average asking price of a typical New Zealand property has risen by $200,000 an increase of 51 per cent.”

While there’s the odd sensational article on ‘greedy landlords’ hiking rents to unprecedented levels evidence proves otherwise and tenants are the winners.

In the regions there has been some catch up with rents rising by double digit percentages in Northland, Manawatu, and Marlborough. However urban average rents have remained stagnant.

This blog article was written for PropertyBlogs by Mobilize Mail.

-

Management5 years ago

Management5 years agoHome Insulation Requirements

-

Investment5 years ago

Investment5 years agoAnother date NZ property investors are dreading

-

Accounting & Finance5 years ago

Accounting & Finance5 years agoLow Interest Rates Winners and Losers

-

Build5 years ago

Build5 years agoHow to Choose and Purchase a Suitable Property to Subdivide

-

Management6 years ago

Management6 years agoAttracting More Business Travellers To Your Auckland Airbnb Property

-

Investment6 years ago

Investment6 years agoWould You Be a Landlord in 2018?

-

Tenants6 years ago

Tenants6 years agoCoworking Countdown – 4 Things to Prepare Before You Move In

-

Renovations6 years ago

Renovations6 years agoFive easy steps to boost the appeal of your home